The numbers indicate: $25,000 is the maximum physical injury responsibility payment under the plan for injury (or deaths) to one person included in a solitary accident - insurance companies. $50,000 is the maximum bodily injury liability settlement that can be made for injuries (or death) to all individuals entailed in a solitary accident. cheap car insurance.

$25,000 is the maximum uninsured vehicle driver settlement that can be made to someone associated with a single accident. $50,000 is the optimum uninsured vehicle driver payment that can be made to all persons associated with a single accident. Persons injured as a result of your driving can as well as typically do take legal action against for problems higher than this example. laws.

low-cost auto insurance vehicle auto insurance affordable

low-cost auto insurance vehicle auto insurance affordable

Ask your agent to discuss the differences between solitary limit and also split insurance coverages. credit score.

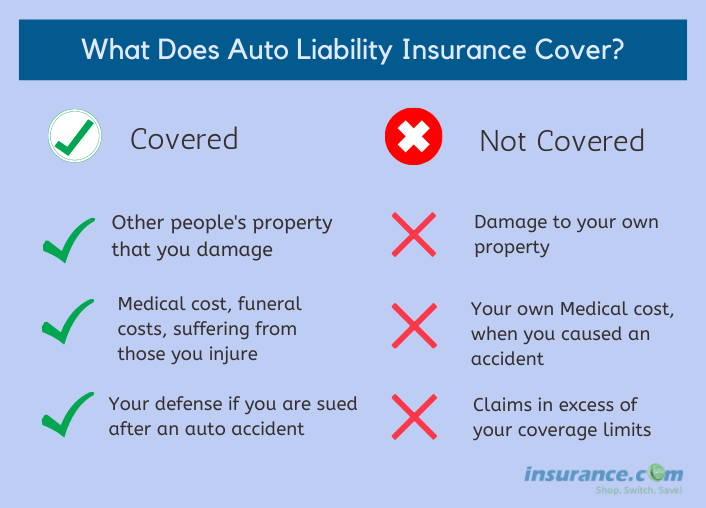

All states call for some form of responsibility insurance policy or evidence of financial obligation to drive on the road legitimately. While purchasing cars and truck insurance policy or renewing your present policy, it is very important to recognize what is and also is not covered under residential or commercial property damage obligation and also just how much insurance coverage you ought to continue your auto plan. cheap car insurance.

car insured business insurance car cheapest car

car insured business insurance car cheapest car

If you create a mishap as well as damages somebody else's property, your insurance policy company will pay on your part approximately the limit provided on your insurance policy's affirmations page. A lot of states provide split protection limitations, while others also use mixed single limitation responsibility insurance policies. With split restrictions, there is a limit per individual and also per mishap that the insurance will certainly pay.

Auto Insurance - The Basics - Office Of Public Insurance Counsel for Beginners

Any type of quantity owed over your coverage restriction would certainly be your responsibility to pay out of pocket - credit score. With a combined single limitation, you have one total up to aid spend for all the responsibility you are accountable for in an at-fault mishap. A combined solitary limit of $300,000 means you have up to $300,000 the car insurer will pay for the entire crash, including bodily injury and property damages.

However, particular standards like your age, state, declares background, credit rating score (in a lot of states) and the sort of vehicle you drive can all influence your price. An additional point that influences the price of residential property damages obligation is the amount of protection you have. laws. How much responsibility protection should you get? Drivers should carry a minimum of the minimum amount of home damages liability insurance coverage needed in their state.

There is no guarantee that the state's minimum called for coverage limit is enough to cover the complete cost of a crash. If you only have $5,000 in coverage and trigger $25,000 in property damages, you might be liable for the $20,000 difference.

Yes, home damages responsibility insurance coverage is needed in almost every state. It is immediately consisted of as part of your liability protection, if you drop the coverage, you can face higher insurance coverage prices when you get reinsured.

credit affordable insurance companies cheapest auto insurance

credit affordable insurance companies cheapest auto insurance

What elements determine the dimension of an insurance claim? The primary element that identifies the dimension of a claim is the price of the repair services. A case that sets you back $200 is taken into consideration a tiny claim, whereas a $10,000 claim is much bigger. Much more comprehensive insurance claims are likewise extra likely to impact your vehicle insurance coverage price when your plan renews. accident.

The Main Principles Of Car Insurance – Liability Coverage

A lot of companies supply coverage limitations as high as $100,000. accident. What are other insurance coverage kinds needed for car insurance policy?

vehicle insurance low-cost auto insurance credit low cost auto

Any type of automobile with a current Florida registration have to: be insured with PIP and also PDL insurance policy at the time of car enrollment. have a Vehicles signed up as taxis should lug bodily injury obligation (BIL) coverage of $125,000 each, $250,000 per incident and $50,000 for (PDL) coverage. have continuous protection even if the vehicle is not being driven or is unusable.

You should obtain the registration certificate and also certificate plate within 10 days after beginning employment or enrollment - cheap car. You should also have a Florida certification of title for your lorry unless an out-of-state lien holder/lessor holds the title and will certainly not release it to Florida. Vacating State Do not cancel your Florida insurance coverage up until you have actually registered your car(s) in the other state or have actually surrendered all valid plates/registrations to a Florida.

Penalties You should keep needed insurance policy protection throughout the registration duration or your driving privilege and license plate may be suspended for as much as 3 years - cars. There are no stipulations for a temporary or hardship motorist license for insurance-related suspensions. Failure to keep necessary insurance coverage in Florida may cause the suspension of your motorist license/registration and also a requirement to pay a reinstatement fee of as much as $500 (car).

occurs when an at-fault party is taken legal action against in a civil court for damages triggered in an electric motor car accident and has not pleased residential property damages and/or physical injury needs. (PIP) covers you no matter whether you are at-fault in a crash, as much as the limitations of your plan. (PDL) spends for the damage to other individuals's home. insured car.

How How Much Car Insurance Do You Really Need? - Moneygeek can Save You Time, Stress, and Money.

In the united state, nearly every state needs Go to this website chauffeurs to have this building damages responsibility coverage to repair or replace victim's individual property so that they don't need to pay of pocket. Without a home damage insurance policy plan, you would be in a great deal of trouble need to you ever trigger an accident.

You would certainly need to pay to repair their car, spend for any surrounding damage (state a wheel flies off as well as strikes one more vehicle), as well as any kind of other damages. The majority of people simply don't have an added $10,000 - $25,000 lying around to cover these expenses - automobile. This is why states have certain minimum limits on insurance coverage quantities that you should buy from your auto insurance policy service provider.