There are a number of factors why you may require to terminate a vehicle insurance plan. Or you want to change to a less costly insurance coverage firm.

The contact number likely will be discovered on your insurance coverage card, in addition to on the firm's web site or application - laws. This is commonly the quickest method, although you still may need to authorize a cancellation notification or other documents to make it official. If your insurance service provider is a lot more old-fashioned, after that you may require to send out a termination letter either to your agent's workplace or directly to the firm.

Due to the fact that it's prohibited to drive without insurance policy in essentially every state, your state's department of electric motor cars might ask you for proof that you either sold the lorry or have actually obtained various other insurance coverage (low-cost auto insurance). If you do not react, then the state can suspend your registration as well as chauffeur's certificate. In some states, you likewise might be required to return your permit plates.

Nevertheless, some insurance companies additionally charge a termination fee if you desire to obtain out of your policy early., make certain to have the new policy aligned prior to you terminate the old oneand inform the new insurance provider exactly when your old policy is readied to expire. Lapses in car insurance coverage are unlawful in several states and also can result in fines. cheaper.

What If Your Insurance Coverage Company Terminates Your Plan? You are not the only one that can cancel your vehicle insurance plan.

Losing Your Insurance - Nc Doi - The Facts

If motivated to talk to the Interactive Voice Response (IVR), state "terminate insurance coverage" and also then "car." You might be asked to state your GEICO plan number, so please have that prepared. Prior to you terminate your policy, there are a couple of things you should take into consideration to be certain it's the best next step.

You have actually moved, also to an additional state. Your plan can simply go with you. Log in to your account, go to the menu, and select "My Policy Information" to begin a new quote.

We offer reduced rate insurance coverage for kept lorries in instance of theft or other damage. You desire to save cash or simplify your insurance policy, because ... You desire other types of policies with one company.

There are a variety of price cuts readily available that might cause a cheaper car insurance policy costs. Once you have actually made certain you're obtaining the optimum discounts with GEICO, be sure you're comparing it to an identical policy from another companyone that has the very same protection, deductibles, and also benefits that you have now. Suppose you have actually chosen that you desire to change insurance provider - affordable car insurance. Can you merely quit paying your old insurance firm? So points were so simple. Even if you have actually bought and also accepted a brand-new policy, that does not mean you're exempt from footing the bill for your various other one. Yes, by regulation, you will practically still be guaranteed, yet you'll also still be responsible for the old expense.

Allowing a policy cancel without alert can create problems; on the other hand, canceling is relatively straightforward. Find out just how to cancel your car insurance in four simple ways, and also learn what takes place when a policy is not canceled appropriately. Key Takeaways Do not presume that your old insurance is terminated just because you have actually changed to a new service provider.

The Best Strategy To Use For If Your Auto Insurance Policy Is Canceled - Illinois.gov

Your new representative may be able to help in the transition and also assist you cancel your old plan. If you fail to terminate your old plan, you could remain to pay costs and even get struck with fees from the state for insurance coverage lapses. Four Easy Ways to Terminate Your Insurance 1.

Sometimes a phone call is all it takes, yet most of the moment a trademark is additionally needed to finish the process (insured car). If you are switching over exclusively on the basis of a lower cost, it could be a great suggestion to call as well as speak to your agent. There might be much more discount rates that can be applied, or perhaps your coverage can be changed on your present plan.

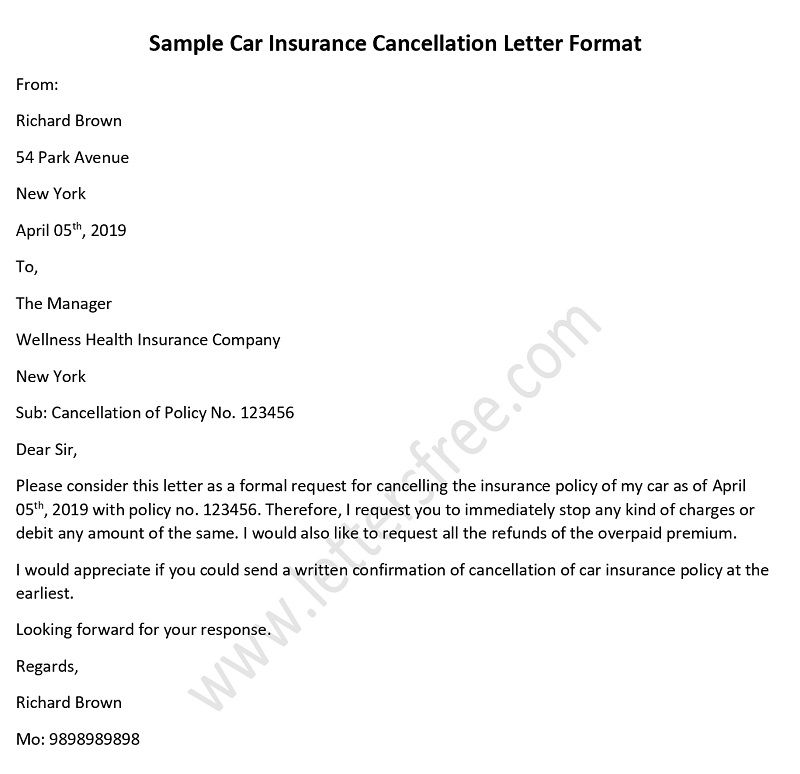

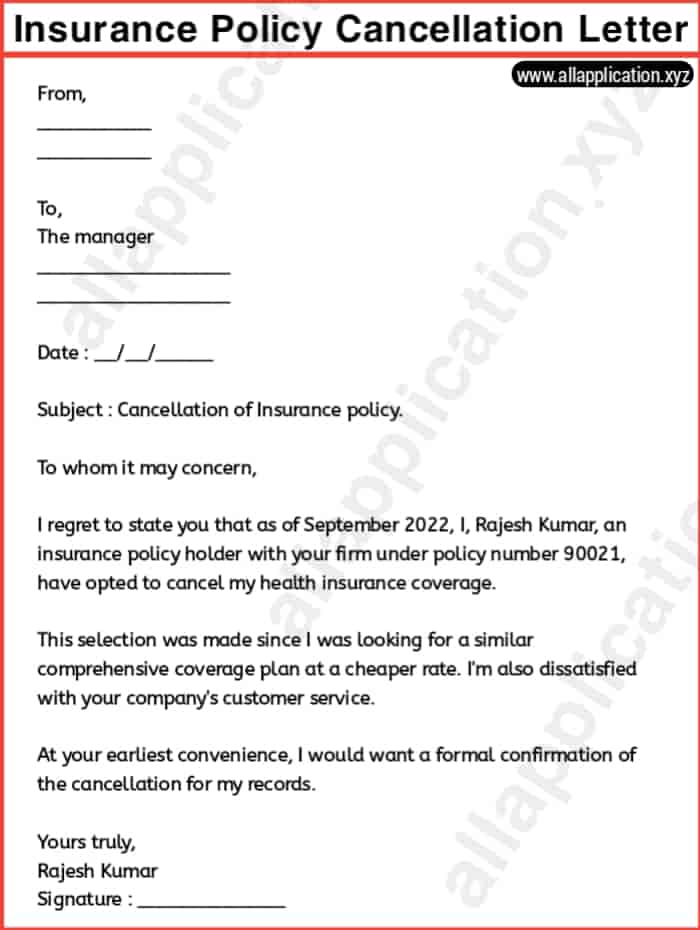

2. Mail or Fax a Composed Demand Authorizing a termination request seals the bargain when it involves canceling cars and truck insurance coverage. It's as simple as composing or keying out the day, your name, as well as plan number, and also asking for cancellation on the date you are intending on changing service providers. Sign the paper as well as mail or fax it to your representative or direct to the insurance coverage carrier.

Authorize the cancellation kind, as well as you'll be on your way - cheaper cars. 4. Ask Your New Insurer to Help Asking your brand-new insurance agent to cancel your old insurance plan is a basic method to finish your cancellation. It's a terrific way to stay clear of any awkwardness with your soon-to-be ex-insurance business.

The document can be faxed to your old insurer. Can I Terminate My Car Insurance Policy at Any Kind Of Time?

6 Easy Facts About Penalties For Cancelling - Pa Dmv Explained

Cancellation fees can vary from an established buck amount as much as a percentage of your total costs expense. Fortunately is that charges are generally not charged for a standard termination, yet plans vary. Talk to your insurance company regarding termination, and also locate out whether you'll be billed any charges or still owe money on the plan.

Do without automobile insurance can place you into a risky swimming pool in several states when it comes time to acquire cars and truck insurance policy once again. 4 Pitfalls of Canceling Without Alert It isn't a good concept to cancel your insurance coverage without letting your existing carrier recognize. Here are simply a few of the challenges of taking that technique.

You'll Have to Pay for the Poise Duration If you do not ask for a termination, as well as you just enable your policy to cancel by itself, you are technically "terminating for nonpayment." Some plans do terminate instantly at renewal without settlement; nevertheless, numerous firms offer an automatic grace period. Moratorium often extend your protection for 20 days.

If you do not pay or supply evidence of another energetic policy, the insurer could send your account payable to collections. 2. You'll Leave a Bad Perception Leaving an insurance provider without offering notification can leave a bad perception. It is a good suggestion to leave on good terms, especially if there's an opportunity you might wish to return at some factor - cheapest auto insurance.

, your plan will likely continue unless you ask for termination. The money will certainly continue to be withdrawn from your account, and also you will have replicate coverage.

An Unbiased View of How To Cancel Your State Farm® Insurance Policy

Various Other Repercussions Insurance firms are called for to notify the state DMV of a lapse in insurance coverage. It might not be sensible to leave it to possibility, also though you've gotten new insurance policy.

You would certainly have to pay a penalty as well as fees for getting them restored (vans). There are unique regulations if your vehicle is a rented automobile. Because instance, you need Additional info to see to it that your brand-new insurance details the renting business as a loss payee. If you don't, the renting company will be alerted that there was a gap in insurance coverage.

No issue just how you terminate your auto insurance, make sure to maintain an eye on your mail for a confirmation letter. Be sure to cancel your insurance coverage after you have your new policy established with a new service provider.

Regularly Asked Inquiries (FAQs) When should you cancel your automobile insurance after selling a car? You need to terminate your car insurance after you've signed the title over and also surrendered your plates to the DMV.

If you're not at the end of your protection duration, validate whether there are any penalties for switching protection with your existing service provider. Next, look for your brand-new coverage prior to your present coverage expires, so you will not experience an insurance coverage space. See to it your new plan starts prior to your present plan ends.

Unknown Facts About Cancelling Your Policy - Liberty Mutual

Terminating your vehicle insurance plan is a very easy procedure, and also generally simply includes a quick contact us to your insurance company. But there are some factors to think about before you dispose your current service provider: While you can cancel your cars and truck insurance policy any time, if you're changing insurance coverage suppliers, ensure to set up your next policy prior to you terminate your present one.

You'll get your money back for your pre-paid costs, yet you may have to pay a fee also. Don't stress, canceling your automobile insurance won't injure your credit scores rating. Yet if you terminate your cars and truck insurance policy while you still have an automobile, future insurers will see that you had a gap in insurance coverage, which can increase your rates.

The number will be on your insurance policy card, in your policy, or online. Business that have applications, like GEICO, Progressive, State Ranch, or Nationwide likely have an alternative to call the business within the mobile application.

Inquire about the termination process. Constantly make sure you recognize the great print prior to you terminate your insurance coverage plan - suvs. Some insurer have unique demands when terminating a plan, consisting of: Termination costs: Many car insurance provider do not charge termination charges, but some charge a charge of $50, or something called a "brief rate" charge, which is 10% of the continuing to be premium you would certainly consented to spend for the policy duration.

The Best Strategy To Use For Division Of Insurance 211 Cmr 97.00 - Mass.gov

Ask your provider for the style as well as the address or telephone number you mail it to, Notification period: Some companies will certainly let you terminate immediately (which you just wish to do if you have brand-new coverage starting immediately), while others require 30 days notice3 - risks. Indicator and also send the termination letter, if needed.

Keep in mind, if you're switching over auto insurance companies, guarantee that you have brand-new coverage lined up that begins on or before your end-of-coverage date. You must set it so your old policy ends on the exact same day that your new policy begins.

What takes place if you just stop paying your cars and truck insurance policy premiums? If you quit paying for your vehicle insurance, it will certainly get terminated, but we do not recommend this as an approach for canceling your plan (auto insurance). For one point, your vehicle insurance coverage firm won't recognize your purpose is to terminate, so they'll request repayments up via your moratorium (the amount of time that you're given to pay your unpaid costs prior to the insurance company cancels your plan).