Anytime you're in an automobile accident and also there are damages to your automobile that would be covered under detailed or accident coverages, you'll be in charge of paying the insurance deductible under each of those insurance coverages. You can pick various deductibles within your auto insurance plan for both accident and thorough - low cost. If you have numerous cars on your auto insurance coverage, you can additionally select various deductibles for every vehicle.

suvs dui cheap business insurance

suvs dui cheap business insurance

You can select different coverage limits for all of them, in addition to established deductibles, relying on which coverage it is - auto insurance. Why can't you constantly pick your insurance deductible? Since not all insurance coverages have them and some, like Personal Injury Defense, have them in some states, and also not others. Deal with your insurance company to identify just how to fulfill your protection needs. credit score.

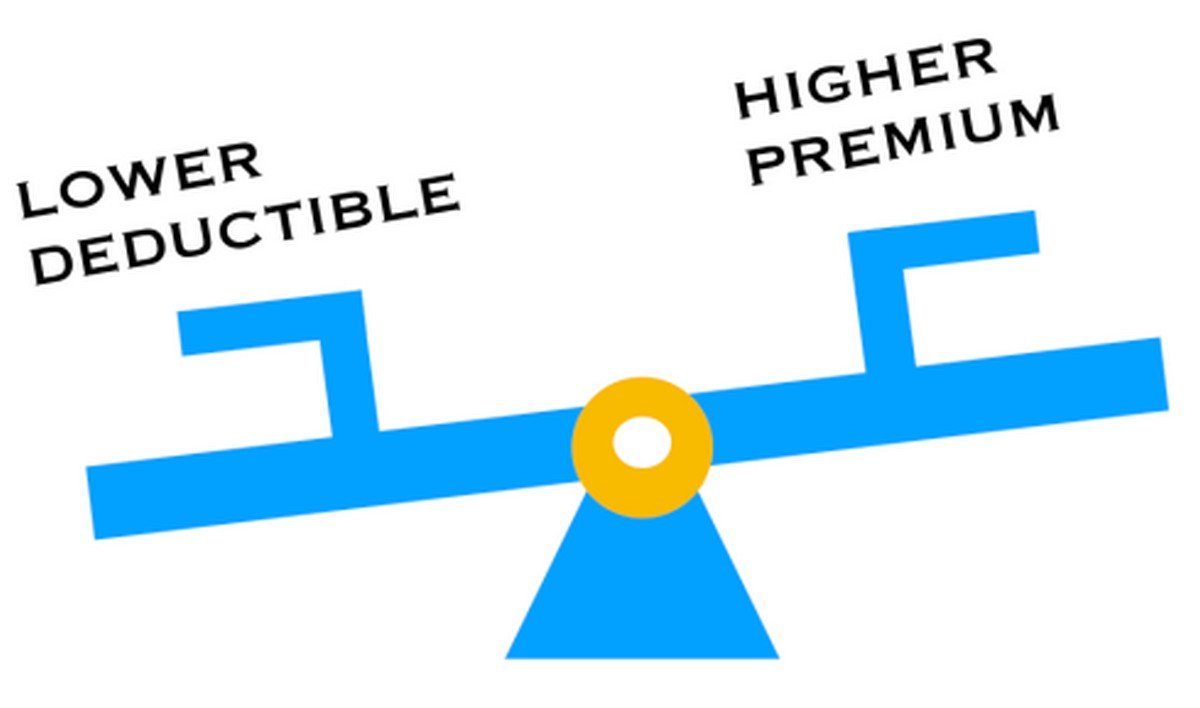

In brief, a higher deductible equates to lower insurance costs. A lower deductible amounts to greater insurance policy costs.

This drops under crash coverage. When picking automobile insurance protection, you selected the low deductible of $500. The insurance firm would certainly now need to pay $9,500. Yet what if you picked a high deductible of $2,500? Then the insurance provider would only have to pay $7,500. They have much less threat, so you'll pay a reduced premium.

Normally, this will be a percentage-based worth of 1% to 10%, depending on the firm, according to the National Organization of Insurance Commissioners (NAIC) (cheap). Wind as well as hail storm (low cost auto). Similar to those for cyclones, these are most likely to show up in policies for areas vulnerable to extreme hurricanes as well as hail storm, such as the Midwest.

Generally, this will be a percentage-based value of 1% to 10%, depending on the firm, according to the National Organization of Insurance Commissioners (NAIC). Wind and also hail. Similar to those for typhoons, these are most likely to appear in plans for areas susceptible to severe windstorms as well as hail storm, such as the Midwest.

7 Easy Facts About Deductibles 101 - Tips & Resources - Grange Insurance Described

Typically, this will certainly be a percentage-based worth of 1% to 10%, depending on the business, according to the National Association of Insurance Coverage Commissioners (NAIC). Wind and hail storm. Similar to those for typhoons, these are most likely to show up in plans for areas prone to extreme windstorms and also hail storm, such as the Midwest - insure.

Usually, this will certainly be a percentage-based worth of 1% to 10%, depending on the business, according to the National Organization of Insurance Coverage Commissioners (NAIC). Wind and also hail. Comparable to those for storms, these are likely to appear in policies for regions vulnerable to extreme hurricanes as well as hail storm, such as the Midwest.

Normally, this will be Additional info a percentage-based value of 1% to 10%, relying on the business, according to the National Organization of Insurance Commissioners (NAIC) - auto. Wind and hail storm. Similar to those for typhoons, these are likely to appear in policies for areas prone to severe windstorms and hail storm, such as the Midwest. auto insurance.

Normally, this will certainly be a percentage-based value of 1% to 10%, depending upon the business, according to the National Organization of Insurance Coverage Commissioners (NAIC). Wind as well as hail - vehicle insurance. Similar to those for hurricanes, these are likely to show up in plans for areas susceptible to serious cyclones as well as hailstorm, such as the Midwest.

cheapest car insurance auto auto insurance low cost auto

cheapest car insurance auto auto insurance low cost auto

Typically, this will certainly be a percentage-based worth of 1% to 10%, depending upon the business, according to the National Association of Insurance Commissioners (NAIC). Wind as well as hailstorm. Comparable to those for storms, these are most likely to show up in policies for areas prone to severe cyclones and hail storm, such as the Midwest.

Normally, this will be a percentage-based value of 1% to 10%, depending on the business, according to the National Association of Insurance Commissioners (NAIC) (cheapest). Wind and hail storm. Similar to those for cyclones, these are likely to appear in plans for regions prone to serious hurricanes as well as hailstorm, such as the Midwest. prices.

Getting The Is Car Insurance Tax Deductible? - H&r Block To Work

Normally, this will be a percentage-based worth of 1% to 10%, depending upon the firm, according to the National Organization of Insurance Coverage Commissioners (NAIC). Wind and hail. Comparable to those for cyclones, these are most likely to appear in policies for areas susceptible to severe hurricanes and also hail, such as the Midwest - laws.

Normally, this will certainly be a percentage-based worth of 1% to 10%, depending upon the firm, according to the National Organization of Insurance Coverage Commissioners (NAIC). Wind as well as hail storm (money). Comparable to those for hurricanes, these are most likely to appear in plans for regions vulnerable to extreme windstorms and hail, such as the Midwest.

Normally, this will be a percentage-based value of 1% to 10%, relying on the firm, according to the National Organization of Insurance Policy Commissioners (NAIC). Wind and also hail storm. auto insurance. Comparable to those for cyclones, these are most likely to appear in policies for regions vulnerable to extreme cyclones and also hail storm, such as the Midwest.

Usually, this will certainly be a percentage-based worth of 1% to 10%, relying on the company, according to the National Organization of Insurance Policy Commissioners (NAIC). Wind and also hailstorm. Comparable to those for cyclones, these are most likely to show up in policies for areas susceptible to serious windstorms as well as hail storm, such as the Midwest.

Normally, this will be a percentage-based worth of 1% to 10%, depending on the business, according to the National Association of Insurance Commissioners (NAIC). Wind as well as hailstorm - vans. Similar to those for typhoons, these are likely to appear in policies for regions susceptible to severe hurricanes and also hail storm, such as the Midwest. insurance companies.

insurance insurance company insured car trucks

insurance insurance company insured car trucks

Typically, this will be a percentage-based worth of 1% to 10%, depending upon the company, according to the National Organization of Insurance Coverage Commissioners (NAIC). Wind as well as hail. car insurance. Similar to those for cyclones, these are likely to show up in policies for regions susceptible to extreme windstorms and also hailstorm, such as the Midwest.